What is Bullish Engulfing Pattern & How to Profit from it ?

- Snehal Patel

- April 25, 2024

Trading in financial markets involves analyzing patterns and indicators. Traders use these to make informed choices. Among these, candlestick patterns play a significant role in predicting market movements. One such pattern that traders often rely on is the bullish engulfing pattern.

Explaining the Bullish Engulfing Candle

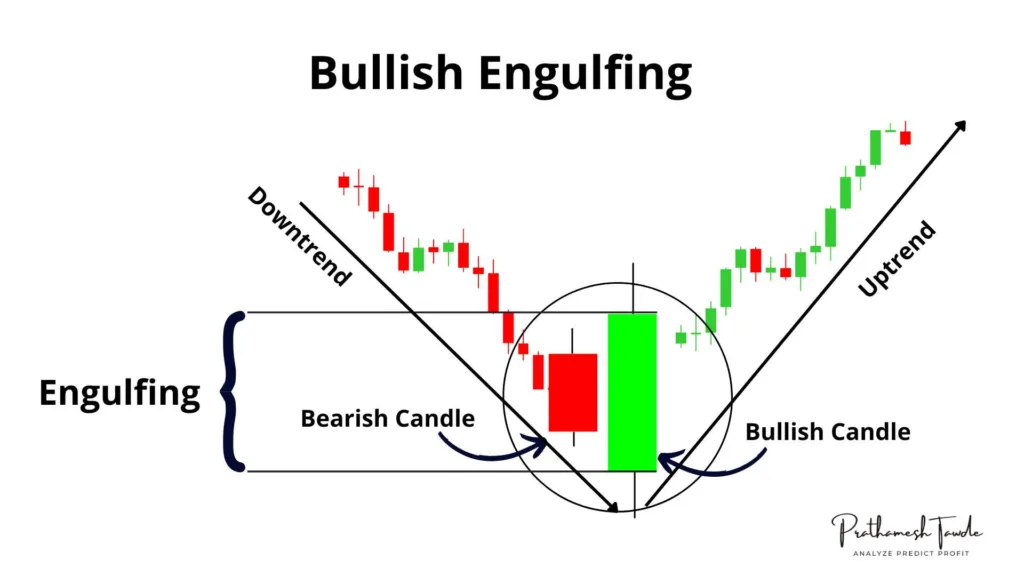

- The pattern has two candlesticks.

- It signals a potential reversal in a downtrend.

- In this case, a larger bullish candle follows a small bearish candle.

- The larger candle completely “engulfs” the body of the small one.

Identification of Bullish Engulfing Pattern

Traders can identify this pattern by looking for specific criteria:

The first candle should be a bearish candle, indicating a downtrend.

The second candle should be a bullish one.

It should open lower than the previous candle closed. Then, it should close higher than the previous candle opened.

The body of the second candle should completely Engulf the body of the first candle.

Patterns are important. They show a sudden change in market sentiment. After a decline, a pattern suggests that buyers are gaining control. This could lead to a reversal of the downtrend.

Trading Strategies Using Bullish Engulfing Pattern

Traders often use patterns as a signal to enter long positions. They may wait for confirmation. This may be a higher high or a close above the high of the engulfing candle. Then, they will start trades. To manage risk, place stop-loss orders below the low of the engulfing candle.

Advantages and Limitations of Pattern

While patterns can be powerful reversal signals, they are not foolproof.

Traders should know the limits. For example, choppy markets give false signals.

They should use extra tools like indicators and also confirm the pattern at various Time different frame

Finding the Pattern

The traditional way to find the Bullish engulfing is to scan through all stock charts and find the pattern

But the simplest way is to use Chartink.com to scan candlestick patterns

Tips for Successful Trading

To maximize the effectiveness of patterns, traders should:

Combine them with other indicators for confirmation.

Use proper risk management techniques.

Continuously monitor market conditions for changes.

Bullish Engulfing Pattern vs. Bearish Engulfing Pattern

In technical analysis, candlestick patterns are vital for traders. They offer insights into market sentiment and possible price movements. Traders often see two key candlestick patterns. These are the bullish engulfing pattern and the bearish engulfing pattern. Both patterns involve two candlesticks. They signal possible trend reversals. But, they have different traits and meanings for traders. Let’s look at the differences between these two patterns. We need to understand their importance in trading.

Key Differences Between Bullish and Bearish Engulfing Patterns:

-

Market Direction: Bullish engulfing patterns happen during downtrends. They signal potential upward reversals. Bearish engulfing patterns happen during uptrends. They signal potential downward reversals.

-

Candlestick Formation: In a bullish engulfing pattern, a bullish candle covers a bearish one. In a bearish engulfing pattern, the bearish candle’s body covers the bullish candle’s.

-

Market Sentiment: Bullish engulfing patterns show a shift from bearish to bullish sentiment. Bearish engulfing patterns show a shift from bullish to bearish sentiment.

Traders must understand bullish and bearish engulfing patterns. This is key for anticipating market reversals and making wise trades. By seeing these patterns and their implications, traders can spot trends better. They can see potential reversals. They can also profit from trading chances in many market conditions. Adding engulfing pattern analysis to their trading strategies can help traders. It can help them navigate the markets with confidence and precision. This skill contributes to their success and profitability in trading.

Conclusion

In conclusion, the bullish engulfing pattern is a great tool. It helps traders find potential trend reversals. Traders can leverage this pattern. They can understand its parts, importance, and trading strategies. This understanding helps them make better trading choices.

FAQs

Yes, bullish engulfing patterns apply to many financial markets. These include stocks, forex, and commodities.

Bullish engulfing patterns can be reliable reversal signals. But, traders should use them with other analysis tools for confirmation.

Patterns appear on many timeframes. These range from intraday charts to daily and weekly ones.

Yes, patterns like the piercing and the morning star share traits with the bullish engulfing. But, they also have distinct features.

Yes, patterns can occur within larger chart patterns. They give extra confirmation for traders.