Three White Soldiers: Mastering Success in 3 Moves!

- Prathamesh Tawde

- October 28, 2023

The Three White Soldiers is a well-respected bullish reversal pattern in technical analysis. Traders and investors use it to spot potential reversals from a downtrend to an uptrend. This allows one to enter long positions early in a new upward movement. This article delves into the details of the Three White Soldiers pattern. It explores the pattern’s formation, importance, usage, and limitations.

Understanding the Three White Soldiers Pattern

Definition

The Three White Soldiers pattern has three consecutive long candlesticks. They open within the real body of the previous candle and close higher. This pattern is common at the end of a downtrend. It signals a strong reversal, marking the start of an uptrend.

Components and Characteristics

- The pattern is called Three Consecutive Candles. It consists of three white (or green) candlesticks. Each has a long body, showing strong buying interest.

- Opening Prices: Each candle opens inside the previous candle. It should be near the middle.

- Each candle closes at or near its high. This reflects strong buying throughout the trading day.

- Candle wicks and shadows are usually short. This is especially true on the downside. It shows that buyers dominate sellers.

Formation and Psychology of three white soldiers pattern examples

Day 1: First Soldier

Appearance: The first candlestick in the pattern marks the end of the downtrend. It is a big bullish candle. It closes higher than it opens. This shows the start of a potential reversal.

Psychology: Traders see this as a sign. It means buyers are entering the market and beating the sellers. But doubt may still linger among market participants, awaiting confirmation.

Day 2: Second Soldier

Appearance: The second candlestick continues the upward momentum. It opens inside the body of the first candlestick and closes higher. This reinforces the buying trend.

Psychology: Traders’ confidence grows as the uptrend looks more real. The second soldier confirms the initial bullish sentiment, attracting more buyers.

Day 3: Third Soldier

Appearance: The third candlestick confirms the reversal. It opens inside the body of the second candlestick and closes even higher.

Psychology: The uptrend lasted three days. It boosted trader confidence. It marked the end of the downtrend and the start of a new bullish phase.

Significance and Confirmation

The Three White Soldiers pattern is very reliable for signaling a bullish reversal. This is because it shows sustained buying pressure over three straight trading days. For a stronger confirmation, traders look for more signals. These include increased volume during the pattern’s formation. This boosts the reversal’s credibility.

Application in Trading

Identifying the Pattern

Trend Analysis: Ensure that the pattern appears after a clear downtrend.

Candle Analysis: each candlestick has long bodies. Also, check that they open within the previous body and close higher. Volume Analysis: More trading on the three days can boost trust in the pattern.

Trading Strategy

- Entry Point: Traders typically enter a long position at the close of the third candlestick. Or, they enter at the start of the next trading session.

- Stop-Loss Placement: Place a stop-loss order below the first candlestick’s is low. This order manages risk.

- Profit Targets: Profit targets vary by the trader’s strategy. Common methods include using key resistance levels. Or, using a trailing stop to capture gains.

How To Find three white soldiers candlestick pattern Using Chartink.Com

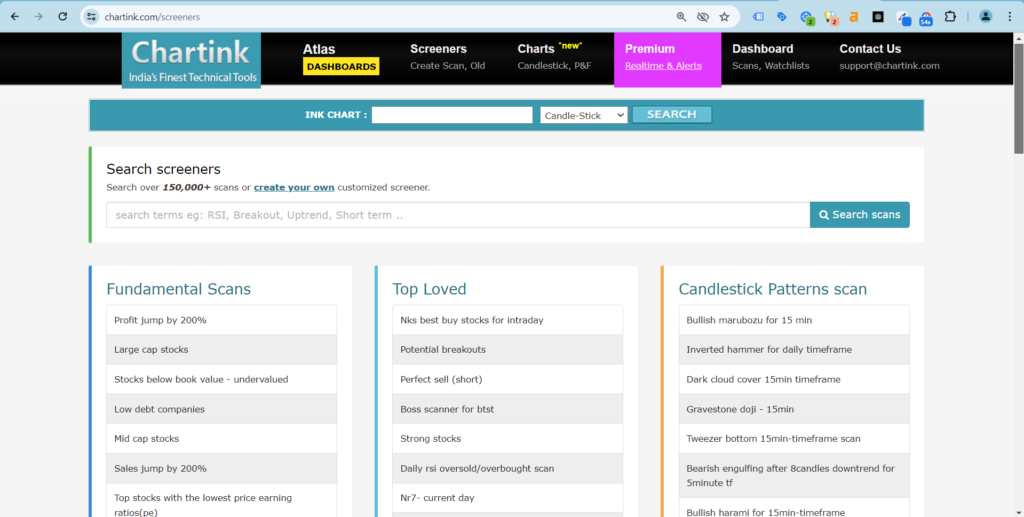

Chartink.com Overview

Chartink.com is an online stock screener and charting tool. It lets traders scan for technical patterns and analyze market trends. Chartink.com has customizable filters and an easy interface. It’s a great resource for traders.

Below is the screenshot of how the websibsite looks , You can simply

You can search for Three White Soldiers pattern in screeners. It will show you all stock charts with a hammer pattern.

Keep in Mind that some Three White Soldiers pattern are wrong and won’t give the right signal. We will only use screeners to find likely hammer patterns.

Limitations and Precautions

False Signals

Despite its reliability, the Three White Soldiers pattern is not foolproof. False signals can occur. This is especially true in volatile markets. It’s also true without confirming indicators, such as volume. Traders should exercise caution and consider more technical tools to confirm the pattern.

Overbought Conditions

Despite its reliability, the Three White Soldiers pattern is not foolproof. False signals can occur. This is especially true in volatile markets. It’s also true without confirming indicators, such as volume. Traders should exercise caution and consider more technical tools to confirm the pattern.

Market Context

Always consider the broader market context. External factors like economic data releases, geopolitics, or sentiment, can influence the pattern. Using both technical and fundamental analysis can improve trading decisions.

Enhancing the Pattern’s Reliability

Combining with Other Indicators

- Volume Analysis: Increased volume during the formation of the pattern adds credibility.

- Moving Averages: Can add more evidence of a trend reversal. They intersect where short-term and long-term averages meet.

- Momentum indicators: Tools like the RSI or MACD can help gauge the strength of the emerging trend.

Risk Management

- Position Sizing: Adequate position sizing based on risk tolerance helps manage potential losses.

- Diversification: This means not putting all your capital into one trade or asset. It reduces overall risk.

- Continuous Monitoring: Check the position and market often. Adjust the strategy as needed.

Advanced Considerations

Pattern Variations

While the classic Three White Soldiers pattern is well-defined, variations can occur. For example, small deviations in the opening prices do not void the pattern. Nor do small upper shadows. But they need careful interpretation.

Multi-Timeframe Analysis

Analyzing the pattern across different timeframes can provide deeper insights. For example, a pattern forms on a daily chart. Similar bullish signals support it on a weekly chart. This strengthens the chance of a sustained uptrend.

Algorithmic Trading

Algorithmic trading strategies can also incorporate the pattern. Traders can automate by programming criteria for pattern recognition. They can then combine them with other indicators. This will let them identify and act on the Three White Soldiers pattern. It will remove emotional biases from their decisions.

Conclusion

The Three White Soldiers pattern is powerful. It is a tool in the arsenal of technical analysts and traders. It signals a strong reversal from a downtrend to an uptrend. This makes it invaluable for finding profitable entry points in the market. But like any technical pattern, it should not be used in isolation. Combining it with other indicators helps. So does keeping a sound risk management strategy. And so does considering the broader market context. These things can improve its effectiveness.

Traders can make better choices by understanding how the Three White Soldiers pattern forms. They should also understand its psychology and use. This can improve their success in the financial markets.

FAQ

The Three White Soldiers pattern is bullish. It is a reversal candlestick pattern used in technical analysis. It has three long white (or green) candlesticks in a row. They open inside the body of the last candle and close higher. This pattern appears at the end of a downtrend. It signals a potential reversal to an uptrend.

To identify the Three White Soldiers pattern, look for:

Three consecutive bullish candlesticks.

Each candlestick should have a long real body.

Each candlestick should open inside the body of the previous one. It should close higher.

The shadows (wicks) should be relatively short, indicating sustained buying pressure.

The pattern is called the Three White Soldiers. It shows a big change from bearish to bullish market sentiment. It shows buyers are gaining control. They are pushing prices higher over three trading days. The sustained buying pressure suggests confidence. It shows faith in a new uptrend. This makes it a strong bullish reversal signal.

While the Three White Soldiers pattern is reliable, it has limitations:

It can produce false signals. This is especially true in volatile markets without confirming indicators.

The pattern can lead to overbought conditions, potentially causing short-term pullbacks.

The market context explains this. External factors, like economic data or geopolitics, can harm the pattern’s reliability. So, use it with other analysis tools. These can be technical and fundamental.

Yes, the Three White Soldiers pattern can be used in many markets. These include stocks, forex, commodities, and cryptocurrencies. You can use it in various timeframes, including daily, weekly, and intraday. But its effectiveness can vary.

Market Type: The pattern is generally reliable in liquid and well-traded markets.

Timeframe: The pattern’s meaning is stronger on longer timeframes. This includes daily or weekly charts. But, it can still be useful on shorter timeframes for intraday trading.

Market Conditions: This strategy works best after a clear downtrend. It may not be as reliable in choppy or sideways markets.

I’m Prathamesh Tawde, a leading figure in the dynamic world of financial markets. Born on March 30, 1986, in the vibrant city of Thane, Maharashtra, I’ve nurtured a profound passion for technical analysis and a commitment to guiding individuals toward successful trading journeys. With a mission to empower and educate, I’ve carved a distinct niche as a content creator, educator, and mentor.